Welcome to the 685 newly Not Boring people who have joined us since last Monday! If you aren’t subscribed, join 32,558 smart, curious folks by subscribing here:

🎧 To get new Not Boring pods right when they come out, subscribe on Spotify or iTunes.

This week’s Not Boring is brought to you by… Mercury

Mercury is banking built for startups. I first heard about the company on Twitter early last year. At the time, Not Boring had about 1,000 readers and $0 revenue, so I stored a mental note away, for a time, one day, maybe, when this thing would start making money. Then, lo and behold, it did! So I went to Stripe Atlas to set up an LLC, and who did Stripe recommend first for banking? You guessed it… Mercury.

You know how I feel about Stripe. I took their word for it and signed up. I’m glad I did. Mercury offers FDIC-insured bank accounts, virtual and physical debit cards, and 3-click payment flows. It’s designed to be fast and simple. My favorite feature is being able to click to copy my account number, routing number, and bank address, right on the main page. Simple but wonderful.

Mercury doesn’t just help companies manage their money, though, it helps them raise it. Mercury Raise connects startups with 170+ top angel investors to pitch their business and, hopefully, but more money in the bank. Plus, it offers a Treasury product and an API that lets you automate your workflows.

See for yourself. Mercury is offering $500 to any new user who signs up with the Not Boring link when they deposit $250k. Join me in banking with Mercury:

Hi friends 👋 ,

Happy Monday!

This is the freshest I’ve ever felt the morning after the Super Bowl. No Super Bowl parties was a new twist, but some things never change: I half-watched the game and half-scrolled Twitter to join the conversation around it.

10% game commentary, 80% that Weeknd gif, 10% Tom Brady appreciation.

I’m an unabashed Twitter fan. It’s the main tool in the Not Boring toolkit, and my little corner of it has become my main online community. Twitter is an infinite game, and once you start figuring out, it becomes magical.

The stock price, however, doesn’t reflect the value it creates, because until now, Twitter hasn’t captured much of it. I think that’s changing.

One thing before we get to Twitter: you should listen to the conversation I had last week with my friend Brett Beller. Brett was the first employee at Drizly, which sold to Uber for $1.1 billion last week. He tells the most honest story you’ll hear about what it was actually like starting a $1 billion company, and how it felt hearing the acquisition news after selling most of his shares a couple of years ago.

Now let’s get to it.

How Twitter Got Its Groove Back

The Dumb But Plausible Bull Case for Twitter

If we’ve learned anything over the past couple of weeks, it’s that markets can be dumb.

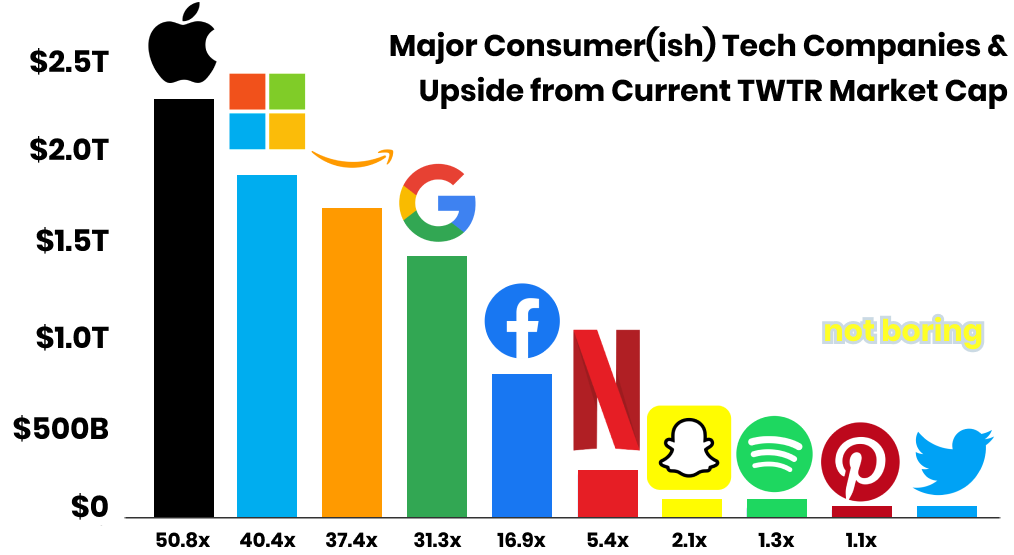

So here’s a dumb bull case for Twitter: it has the lowest market cap of any public tech company that you use every day -- at $45 billion, Twitter’s market cap is just 2% of Apple’s and 5.9% of Facebook’s -- and that will change once the narrative around the company does.

I know, I know. This isn’t how this is supposed to work. I used a similar argument to highlight Snap’s potential upside in Oh Snap!, though, and it is kind of working. SNAP shares are trading up 215% since I wrote that piece in June.

Snap has performed well, but they didn’t triple revenue. They’re not even profitable yet. So what happened? The narrative around Snap changed. This isn’t a struggling dick pic company that can’t acquire older users and is getting its lunch eaten by Instagram Stories anymore. This is a company that has huge engagement numbers with Millennials and Gen Z, increased interest from advertisers, credible international expansion plans, increasing ARPU, and a call option on becoming the Augmented Reality platform of the future, Mirrorworld.

When you look at it that way, you stop focusing on things like EV/EBITDA, or EV/Revenue, and focus on growth. You don’t worry about whether the floor will drop out; you dream about just how high the ceiling might be.

Of course, it helps that Snap figured its shit out right when the market got downright ravenous for growth. Interest rates are so low that investors are acting like something that could possibly happen in the future has already happened. Investors want to believe; it’s the company’s job to make them believe.

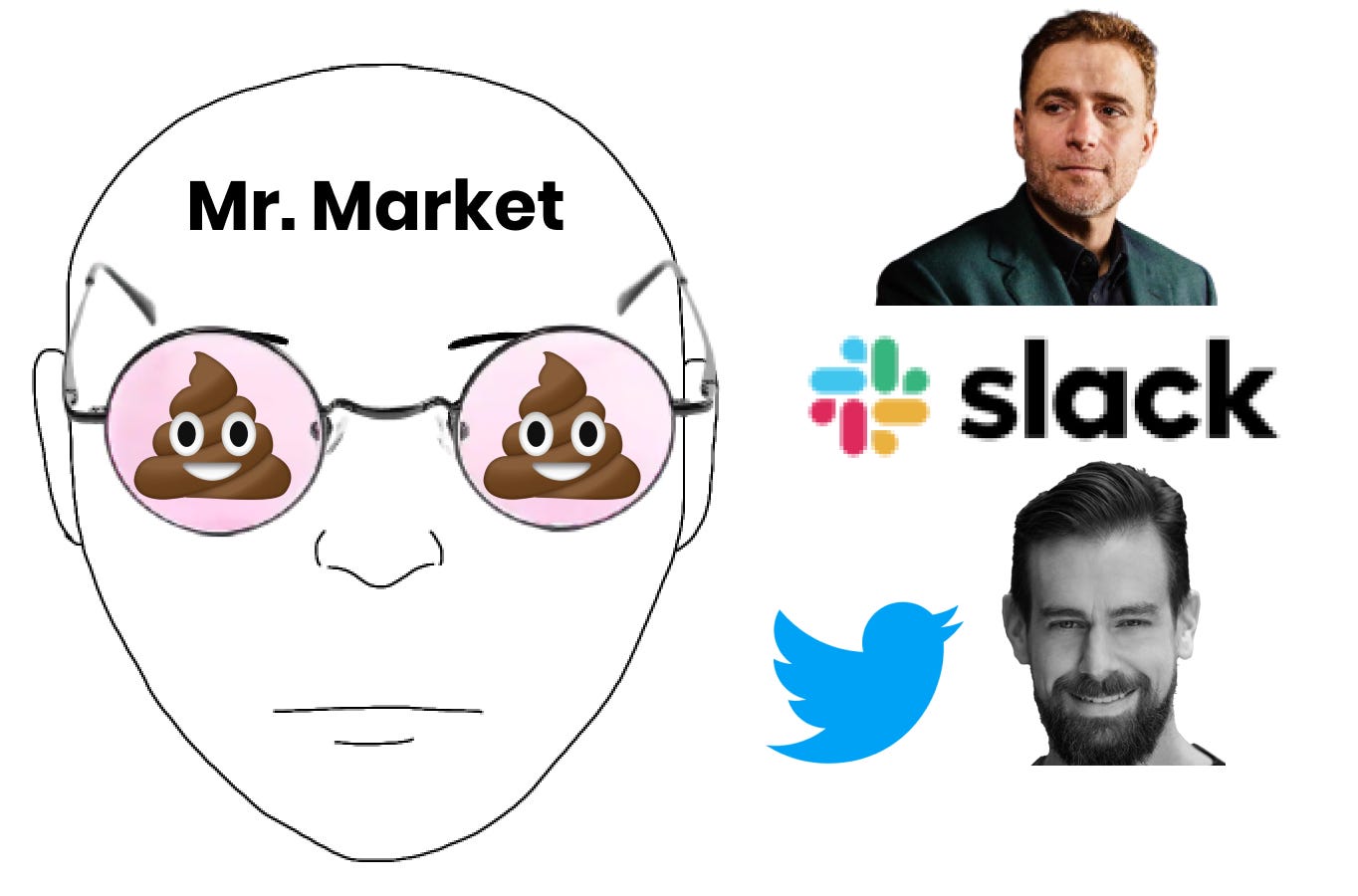

That’s why I’ve come to love narrative investing. Narrative investing isn’t about finding the company with the best story; it takes advantage of the collective narrative bias of the market, the tendency of investors to view investments through the lens of a narrative, forming a simple story and ignoring data that doesn’t fit the story. In Slack: The Bulls are typing…, I illustrated the idea by saying that the market looks at anything Slack does through shit-colored glasses. It’s largely looked at Twitter the same way.

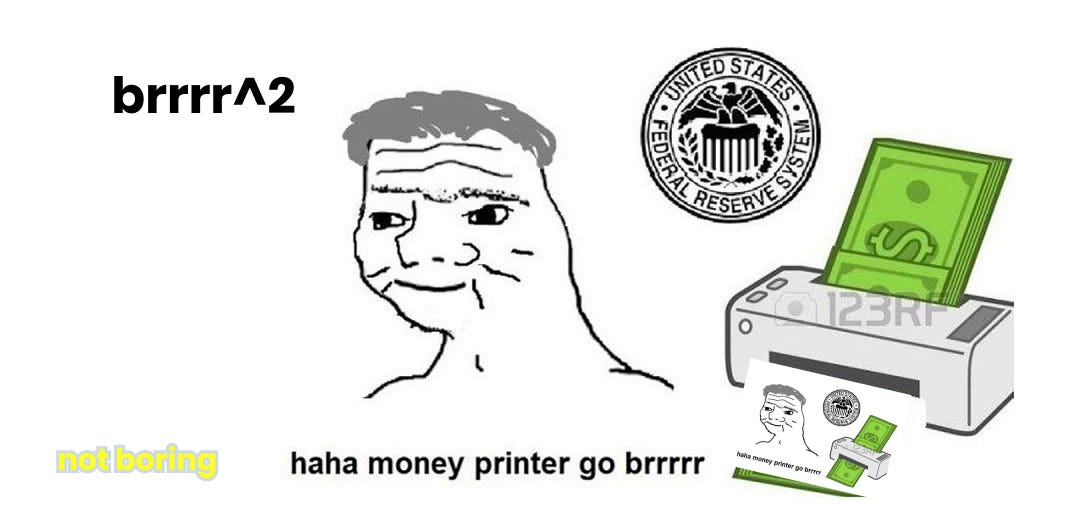

In this market, value is dead (jk sorry value folks!), obvious growth is crowded, but finding that inflection point when the narrative around a company switches from dead to very much alive is like finding a magical money printer in a market fueled by a magical money printer. brrrrrr^2

That’s what happened with Snap. It’s what happened with Spotify, when it changed the narrative from “structurally low margin music business” to “leading audio company” in the stroke of a few podcast deals. It’s what would have happened with Slack (I swear!) before Salesforce saw the potential and snatched it up.

And, I think, it’s what’s going to happen to Twitter.

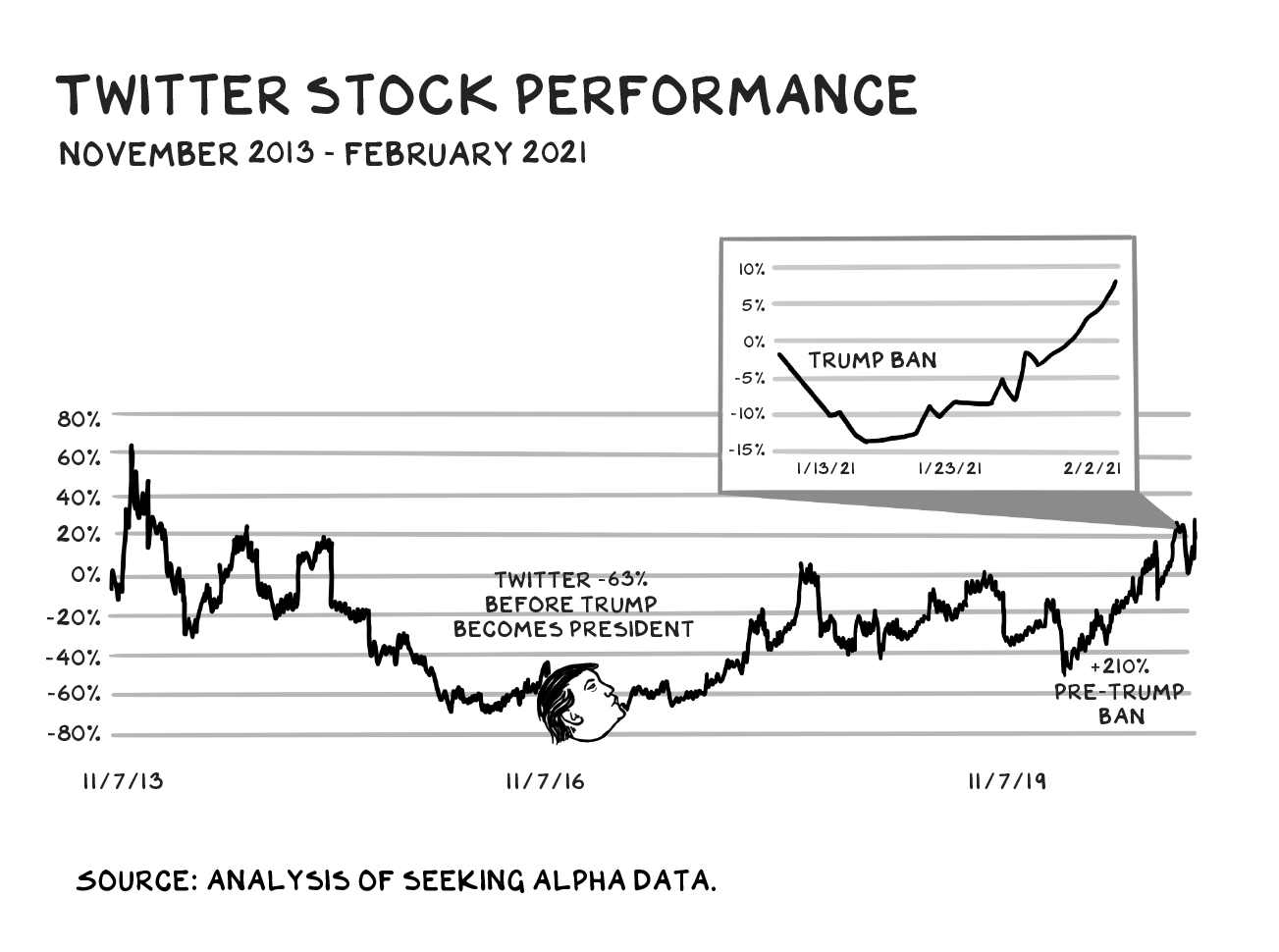

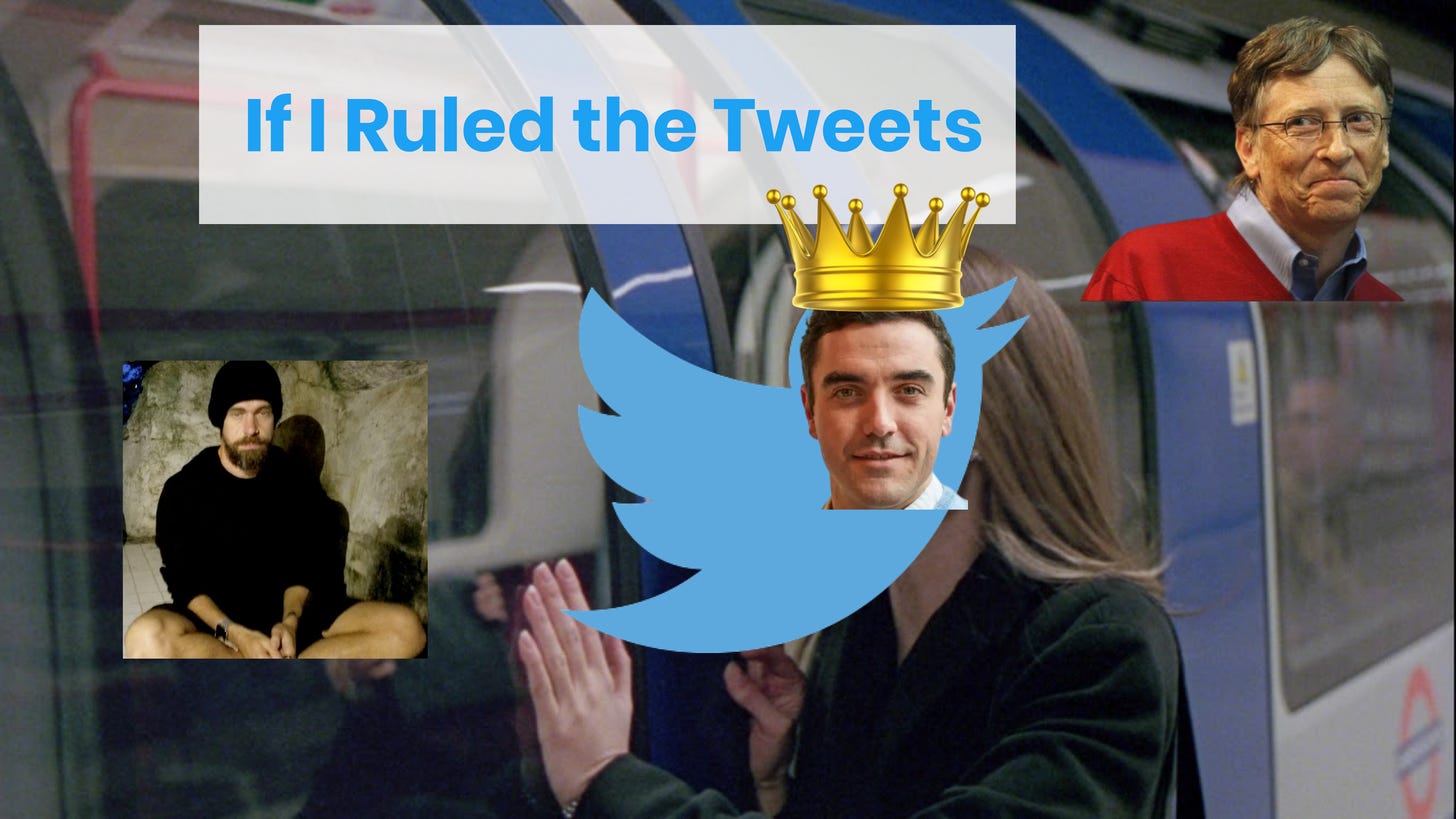

Am I late to the party here? A little. $TWTR is up 70% over the past year, more than any of the FAAMG stocks save Apple. But zooming out, Twitter is practically flat for its entire history as a public company. Back in the day, in 2013, when Twitter IPO’d, it was right there with Facebook. Since then, as I wrote in If I Ruled The Tweets, Twitter has stayed pretty much flat, while “Facebook, lacking scruples in its pursuit of Rubles, has more than quadrupled.”

I wish I’d called it then; Twitter is up 68% of its 70% 1 year growth since I wrote that essay in July outlining what I thought Twitter should do to jumpstart itself. I think Twitter might have read the piece, because they’ve started to do some of the things I put on the crowdsourced Fantasy Jack Twitter Roadmap.

Twitter has started to do what it should have done all along -- focus on its power users. The launch of audio-chat rooms, Spaces, and acquisition of a newsletter platform, Revue, make me optimistic that they’re able to execute on the rest of the roadmap too.

The company is getting its groove back. If either of these moves, or other bets Twitter is making, begin to show promise, the narrative is going to shift and Twitter will rip. People want a reason to buy Twitter.

With Twitter earnings tomorrow, now’s the perfect time to get smart on what the company is up to and where it’s heading. To do that, we’ll cover:

Prof G vs. Twitter. Scott Galloway ripped the company and its CEO, Jack Dorsey, last week. It’s a good summary of the critics’ view, and a bullish signal.

If I Ruled the Tweets. Twitter needs to focus on its power users and make products that help them share their ideas and make money.

How Twitter Got Its Groove Back. Twitter grew usage, improved its ad product, and survived the election. Now it’s focused on what’s next with the acquisition of Revue and launch of Spaces.

Twitter’s Creator Bundle. Twitter is in the best position to build or buy a bundle of tools for Creators. Plus, why I think it can beat Substack and Clubhouse.

Changing the Narrative. Adding up the sum of Twitter’s parts.

There are a lot of reasons to be bullish on Twitter, but maybe none more so than the fact that Prof G is yelling about the company’s issues.

Prof G vs. Twitter

Last week, Professor Scott Galloway wrote about Twitter, both in New York Magazine and his own site, saying of the company, “We know it’s terrible for society. But it’s also a terribly run company.” Historically, the Prof calling something terrible has been a buy signal.

It’s typically poor form for one writer to dunk on another, but I make an exception for professional dunkers. If you’re going to make a living dunking on companies, including private ones, you do so knowing that you’re going to get dunked on too. The Prof has made a name for himself by being loudly bearish on all sorts of tech or tech-adjacent companies, and getting his calls wrong at an incredible rate.

Julie Young created the “Anti-Galloway Portfolio” in June last year, and @yashpatodia built a public spreadsheet that tracks it in real-time. If you bought the stocks that the Prof said were overvalued or “will lose 80% or disappear” on October 4, 2019, when he created the list, you would be up 383%, or 223% annualized. For context, the Anti-Galloway Portfolio is outperforming the Nasdaq by 8.8x and the S&P 500 by 12.1x over the same period.

Now, a few things:

The Prof has many more subscribers, followers, listeners, students, fans, etc… than I do. He’s entertaining and what he’s doing is working for him.

It’s working so well that here I am highlighting his work. The irony isn’t lost.

He’s also sold companies, served on private and public boards, is a professor at NYU, and has a lot more money than I do.

He owns $10 million of Twitter stock and has been advocating that Twitter replace Jack Dorsey since he wrote a letter to the board in December 2019.

Since he wrote that letter, the company has made none of the changes that the Prof suggested. Activist hedge fund Elliott Management and less activist fund Silver Lake both came in last March, though, and put Jack on a Performance Improvement Plan. Jack passed, for now. He’s still the CEO. And the company’s stock is up 88% since Galloway’s letter.

Since they didn’t listen to him the first time, he wrote practically the same thing again last week, a year later. It’s worth summarizing here, because it’s a good overview of the critics’ case against Twitter, and of the type of lazy proposed solution that must infuriate the Twitter team.

Here’s the Prof’s argument against Jack and Twitter management:

Twitter has underperformed the market since it went public in 2013. The Prof isn’t wrong! Twitter’s performance as a public company has been uninspiring: even after its run-up over the last year, it’s up only 26% since its 2013 IPO, while social media competitors and other major consumer(ish) tech companies have soared.

Spotify, Snap, and Pinterest, which all IPO’d after Twitter, are up 87%, 165%, and 245% from their first IPO-day trade, respectively.

After three years in the doldrums, the Prof argues, Donald Trump saved the platform by winning the Presidency, and reversed the company’s 63% slide. To bolster his case, the Prof put a big fat Trump head over the 9-month period after Trump’s election during which Twitter’s stock was relatively flat. Never let the facts get in the way of a good story!

Rebounding because of Trump was a deal with the devil, he argues, and one Twitter had to make because of its business model. Twitter is cool with toxic content, so this argument goes, because that’s good for engagement which is theoretically good for Twitter’s ad business. The ad business isn’t just bad because it encourages toxicity, though, it’s bad because Twitter isn’t big enough to make it work. Then he throws in a chart of Twitter’s Average Revenue Per User (ARPU) versus The New York Times, CNN, and Facebook.

Plus, now that Trump is banned, Twitter’s going to have problems! The Prof pointed to a 5% slide when the company banned Trump, but Alex Katrowitz points out that Banning Trump Didn’t Change How Much People Use Twitter. The Prof ignored the flat trading at the beginning of Trump’s presidency and then highlighted a quick, one-time drop as confirmatory evidence that the company is now in trouble. That’s narrative bias in action.

Plus, PLUS! Twitter CEO Jack Dorsey was in French Polynesia, where rich people go 🤮, when the Capitol insurrection occurred.

And he speaks less than most CEOs on earnings calls (only 6% on the last one), because he’s checked out and leads two companies (including Square, on which company’s earnings calls he speaks a lot more). Worse, and this is a good point, he thinks that Twitter should have its own payments, but that they don’t because Jack is conflicted thanks to Square.

All of this -- Twitter’s business model, Jack’s absenteeism, conflicts of interest, and a too-friendly board -- combine to not just produce bad results, but a “threat to the Commonwealth.”

So what does the Prof think Twitter should do about it? Three things.

First:

Twitter needs to move from an ad model to a subscription model, with subscription fees for accounts of a certain size. The platform would still be free for the majority of users, but accounts over 200K followers (or even 50K followers) should pay for the audience that Twitter provides them with.

This is an idea that Galloway has been pushing for a while, and he keeps using Kim Kardashian and her 69 million followers as an example. While I agree with adding a subscription model (the company does too), this is so clearly not the way to do it. As I wrote in July, “A half-baked subscription product that extorts Twitter’s top users based on the follower counts they’ve spent years building up doesn’t make any damn sense.” It’s lazy, the math doesn’t work, and it misunderstands Twitter users.

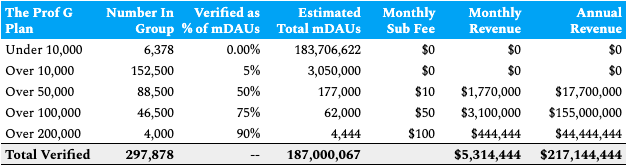

Let’s look at the math. There’s no good data on the distribution of Twitter follower counts, but the closest I found is this 2019 histogram of all 297,878 verified twitter users’ follower counts.

Doing some rough estimates and back of the envelope math here, assuming that Twitter accounts are more likely to be verified the more followers they have, and even generously increasing the monthly subscription fee with more followers, the Prof’s plan generates a measly $217 million in revenue, even assuming every user over 50k followers pays up.

(Yes, he also has a YouTube video in which he shows that just 15% of Twitter’s 187 million mDAUs would need to pay $10/month to make up the $3.4 billion it generates today.)

Make the subscription $10/month for everyone, that drops to $24 million. In exchange, the Prof believes that the revenue generated by subscriptions would encourage Twitter to add premium features to justify collecting premium revenue. The logic is confusing and confused -- the Prof believes that Twitter is already so valuable to power users that they would pay for the product immediately, but that having paying customers would light a fire under Twitter’s ass to produce more premium features.

It’s also the wrong way to treat power users, the people who create the content that attracts other people to the platform. “You have a lot of followers, pay up” will lead to a mass exodus and open the door for a new platform that promises to help influencers make money, not pay it.

Second, the Prof thinks that Twitter shouldn’t just charge its most active and popular users, but that it should compete with them, too, by creating its own content:

As it builds a business around its users, Twitter should acquire or create its own content. Both Spotify and Netflix’s stocks accelerated once they began investing in their own programming. Twitter is already a destination for news and entertainment content, and if it added its own vertical — high-quality political journalism, for example.

Emphasis mine. Twitter doing political journalism? It would be a lot more fun to just print out a bunch of copies of Section 230 out and light them on fire. Section 230 is a piece of legislation that protects platforms from responsibility for the content that its users post, and is what social media companies lean on when things like, say, insurrections are planned on the platform. Getting into first-party political journalism seems like a pretty quick way to lose that protection.

Not to mention, creating content that competes with users’ content is antithetical to Twitter building a business around the users who create content on the platform. Here, the Prof uses a lazy analogy to Spotify and Netflix, two companies whose stock took off once they started creating their own content. That analogy ignores what makes Twitter special: that it’s able to get great content from the best minds in the world, for free, in exchange for helping them find an audience.

Third, the Prof argues that Jack needs to go:

I can't believe I even have to say this: We should remove a part-time CEO. Twitter’s management, enabled by legacy board members, has demonstrated an alarming disregard for the commonwealth, weak strategic thinking, and an inability to create a fraction of the shareholder value that is possible for the platform. Twitter’s financial weakness gives it a chance for redemption. It’s time.

We’ll get back to this.

There was a fourth piece, too, in the New York Magazine piece:

I believe that the most undervalued real estate on the internet is Twitter profiles.

That one I actually agree with... because I wrote it in July:

🤔 If you’re reading this one, too, hi Prof!

Interestingly, the Prof said that one of the reasons Twitter should enhance profiles is that they’ll give advertisers richer data with which to sell ads, even as he argued that the ad-based model was the reason Twitter was a threat to the very foundation of our democracy. I dunno.

This is why Prof G irritates me so much: it’s easier to dunk on companies than it is to come up with good solutions to the challenges they face than it is to execute on those solutions. Talking shit and coming up with even worse ideas takes a special kind of confidence.

The subscription idea isn’t wrong, per se, he just hasn’t developed the thinking behind it nearly as much as he’s talked about it. We have, though.

If I Ruled the Tweets

In July, in If I Ruled The Tweets, I wrote about Twitter’s challenges and laid out a roadmap for the company based on over 300 replies to this tweet:

In a beautiful demonstration of the power of Twitter: by crowdsourcing ideas for how to fix Twitter, we collectively came up with a coherent understanding of Twitter’s challenges and a roadmap that predicted some of what Twitter is doing today. I’ll summarize it here.

Twitter’s challenge, and opportunity, is that it gives away so much more of the value it creates than any other major tech company. Entire businesses are built on Twitter without Twitter capturing a dollar. Not Boring is one very small example. I find potential sponsors on Twitter, and then take the transaction over to Substack. This is what Aggregators do: they aggregate demand, and collect a tax for sending it to its final destinations.

But Twitter is a very bad Aggregator; it barely collects the tax. It’s not big enough and, to date, its ad products haven’t been good enough (although the company spent 2020 rebuilding them).

Instead of an Aggregator, Twitter might be a Platform that is further above the Bill Gates Line than any other company on earth. The Bill Gates Line is a phrase coined by Ben Thompson based on a Bill Gates quote about Facebook Platform:

This isn’t a platform. A platform is when the economic value of everybody that uses it, exceeds the value of the company that creates it. Then it’s a platform.

Embracing its status as a platform is one way for Twitter to monetize. Embracing its role as a professional network instead of a social network is another. LinkedIn is a good model here. If on ad-supported social networks, like Facebook, advertisers are the customer and users are the product, on LinkedIn, most users are the product, but power users are the customer. Only 18% of LinkedIn’s revenue pre-Microsoft acquisition came from ads; the rest came from selling tools to power users, both companies and individuals.

For Twitter, its power users, and the people who should be its customers, are the 10% of users who generate 80% of the tweets. We’ll call them Creators. The Creators’ Job-To-Be-Done is to get their ideas, products, newsletters, courses, videos, podcasts, investment ideas, and the other things they’re selling in front of people. I argued that it should create a subscription product for those users, not based on follower count like the Prof suggests, but in exchange for power tools and monetization options.

Based on the suggestions I received on Twitter and the logic above, I came up with a four-point Fantasy Jack Twitter Roadmap, not to replace ad revenue (the company wouldn’t do that) but to augment and eventually overtake it:

Revamp User Verification. This is table stakes. Twitter should allow people, companies, and pseudonymous accounts to easily verify themselves, and allow users to filter their Twitter experience to include only verified users.

Build Twitter+, a Subscription Product for Creators. Instead of the Prof G follower tax, for a monthly fee, Twitter should give creators better tools to create and share ideas, including making it easier to work with bookmarks and take notes, better search, improved DMs, live presentations, paid 1-1 video, free promoted tweets, and early access to new features. Opportunity: $1 billion ARR.

Products for Creating, Sharing, and Monetizing Ideas. “Twitter is the place that Creators go to grow subscription businesses. Twitter Create should be the place that they go to build subscription businesses.” We suggested Memberful-like subscription tools, a newsletter product to compete with Substack, a podcasting app, storefronts, paid communities, and audio-only rooms. Opportunity: $2 billion.

Make Profiles Incredible Places to Hangout. If Twitter is the Town Hall, profiles should be the back rooms where business gets done. Twitter should be more experimental with profiles since they’re hidden away from the core product experience, letting people personalize, set up storefronts, create spaces to hang out, and build a more direct connection with friends and followers.

Twitter might have been listening. It’s getting its groove back.

How Twitter Got Its Groove Back

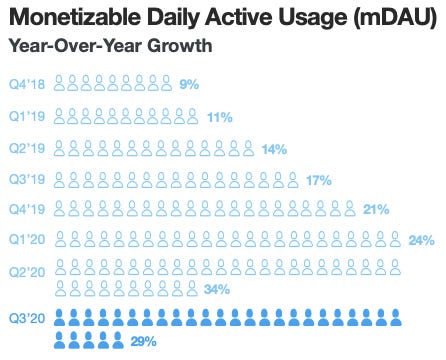

2020 was a good year for Twitter. Since Elliott Management and Silver Lake took board seats in March, $TWTR is up 94%. As of Q3, the company had 187 million monetizable Daily Active Usage (mDAU) up 29% from the previous year. For context, Facebook grew DAUs by 12% over the same period, albeit off a much higher base.

At the start of the pandemic, Twitter decided to prioritize its revenue products, and after a slow Q2 due to the pandemic, the company roared back. Revenue grew 14% YoY to $936 million in Q3, smashing estimates. Twitter has mostly focused on brand advertising to date, but aided by the rebuild of its ad server, it has started rolling out direct response ad formats, and will launch a new Mobile Application Promotion offering this year. It’s also working on tools to let SMBs better self-serve ads, overhauling what has traditionally been an absolutely terrible product.

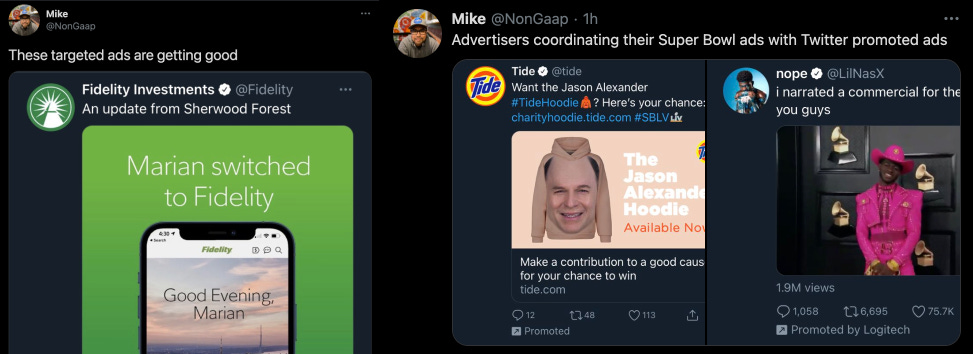

It might be working, too. Last night, @nongaap highlighted a few ads during the Super Bowl that seem more targeted, timely, and relevant than anything I’ve ever seen on Twitter.

If Twitter finally gets ads right, that’s a huge tailwind, but the most exciting thing about Twitter is that it’s started making moves against the Fantasy Jack Twitter Roadmap.

Verification. After nearly four years of letting verification languish, shrouded in uncertainty, Twitter announced in November that it’s bringing back its verification program. It will keep its focus on organizations and influential individuals for now, and isn’t moving all the way towards verifying all real people and companies, but it’s a step in the right direction that shows it’s listening to users.

Subscription Products. While Twitter hasn’t launched any subscription products yet, it has publicly announced that it’s planning to, and that it’s being more thoughtful about it than the Prof. At the Oppenheimer Technology, Internet, and Communications Conference in August, CFO Ned Segal said:

When we think about subscription, I wouldn't want you to think too narrowly about the opportunities. There could be subscription opportunities for advertisers. There could be subscription opportunities for consumers. There could be -- whether they are people who use the service a lot to create content or those who tend to be viewing content more or those who are somewhere in between. We don't feel constrained when we think about these opportunities, and I wouldn't want you to think so either.

Notice that he didn’t mention Kim Kardashian’s 69 million followers once, but he did highlight Creators.

Products for Creating, Sharing, and Monetizing Ideas. This is where Twitter has gotten most aggressive recently. Let’s break it out.

In If I Ruled the Tweets, we suggested that Twitter should build or acquire products for newsletter creation, podcast consumption, and audio-only rooms, among other things. After years of soporific product development, they’re actually starting to make moves!

In December, Twitter acquired social screen-sharing app Squad and announced the launch of Spaces, its answer to audio-chat unicorn Clubhouse. Spaces lets Twitter users host conversations directly within the app, and the Squad team will work on the product.

In early January, Twitter acquired Breaker, a social podcasting app, to help build Spaces. Then, two weeks ago, on January 25th, Twitter acquired newsletter platform Revue.

Combined, these moves point to a more confident Twitter, that, election behind it and Trump out of its hair, is focused on the future. It is going to build Creator-focused products and diversify its revenue streams. The pieces are starting to come together.

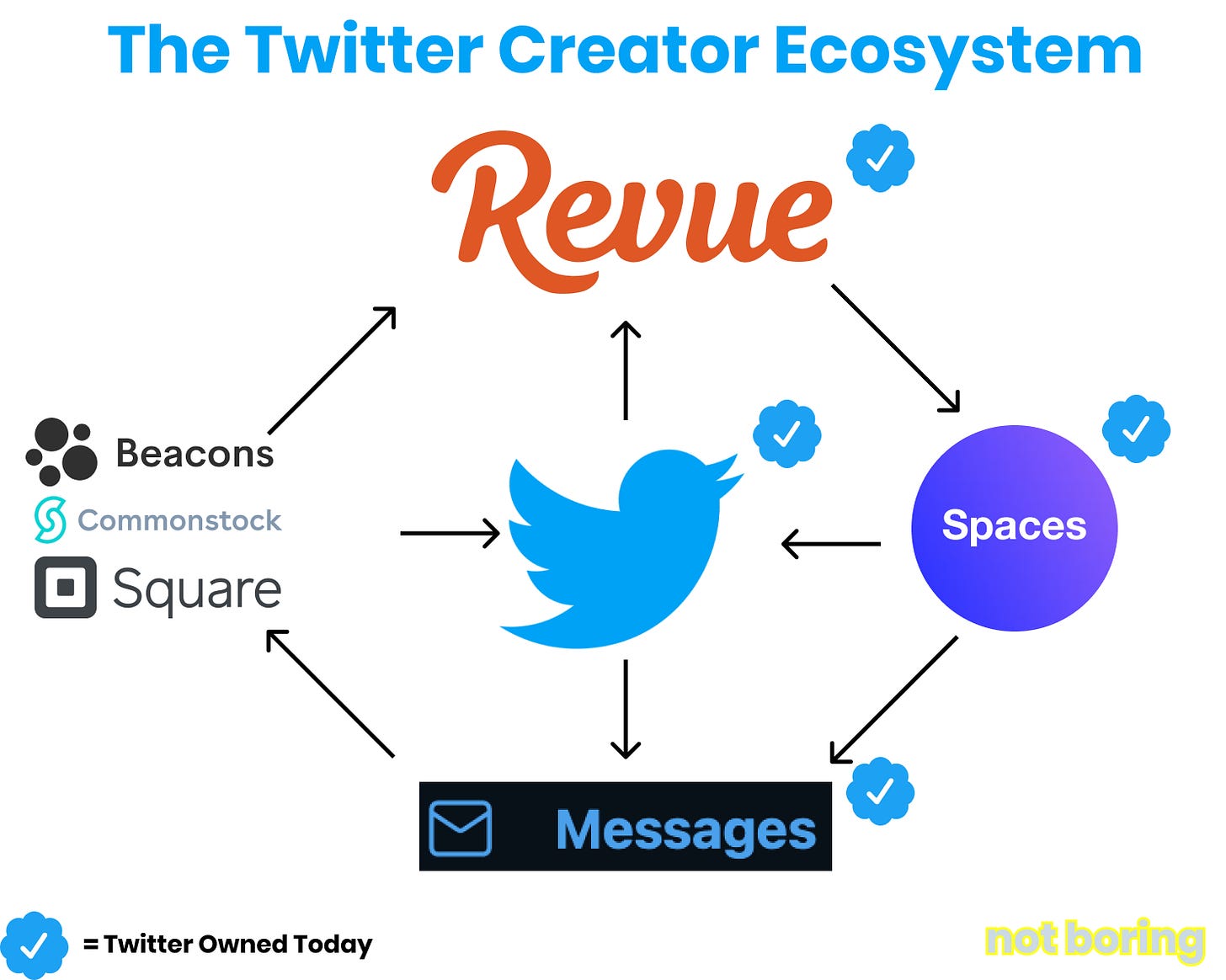

Twitter’s Creator Bundle

With the launch of Twitter Spaces and the acquisition of Revue, Twitter is building a Creator ecosystem in which it keeps some of the value it creates. It’s competing with two hot, a16z-backed startups, Clubhouse and Substack, to own the conversation and the associated monetization opportunities. I think it will win the newsletter wars, which will give it a leg up in the audio wars.

When Twitter acquired Revue, Ben Thompson wrote about the acquisition, calling it “the smartest thing Twitter has done in ages.” I agree. In If I Ruled the Tweets, I used Twitter’s relationship with Substack to show how much value it gives away, writing of the fact that most Substack discovery happens on Twitter:

Who’s capturing the value here?

The writer captures value in the form of a new free or paid subscriber.

Substack captures value in the form of new paid subscribers and new writers.

Twitter captures almost zero value. You could argue that it captures a little in the form of increased engagement that it can sell ads against, but when one of its users sees a Substack post and clicks the link, she leaves Twitter and gives her attention to Substack.

Substack is in a tricky position. For writers to stick with Substack when they get big despite the 10% fee Substack charges, it will need to help them drive growth. The most effective tool that Substack has built for discovery, though, is a tool that helps people find Substacks by people they follow on Twitter!

Twitter can make the whole newsletter discovery experience more seamless and integrated by doing it all within the app, as Thompson lays out well here:

Personally, I’m watching closely and would love to switch to Twitter Newsletter as I learn more about the company’s plans for the product. It’s where I promote Not Boring anyway, and connecting with Twitter would allow me to find new readers more easily and learn more about all of you.

For new writers, Twitter is trying to make it as easy as possible to start a newsletter, already highlighting it in the “More” menu on the web version of Twitter.

At the same time, Twitter is preparing to do battle on the audio-room front with Clubhouse via its Spaces product. It’s still in limited beta, but one of the early testers, Chris Cantino, wrote a good breakdown in Twitter Spaces: A Bright Future.

Like Substack, much of Clubhouse’s growth has come on Twitter’s back. The product initially took off when a small set of influential users shared screenshots of the app on Twitter in the spring, creating FOMO and demand, and still today, Twitter is the main distribution channel for Clubhouse. When Elon Musk went on Clubhouse last weekend, he let people know… on Twitter.

The conversation about the conversations in Clubhouse also happen on Twitter. When I woke up the morning after Elon’s appearance, my entire feed was Tweets about what Elon said, or when he brought Robinhood’s Vlad Tenev on-stage. Clubhouse hosts even take audience questions on Twitter.

Twitter should be able to close the loop - go live, join the conversation, ask questions, and tweet about the conversation, all in real-time, in one place. Record snippets of public conversations and tweet them directly. DM other participants.

Critics argue that, yes, a theoretical Twitter could do that, but actual Twitter, the one that acquired and squandered Vine, can’t figure out search, and let DMs turn into a complete warzone, cannot. Twitter can’t build product, they say.

I’m more optimistic about Twitter’s potential here, for a few reasons:

Audience Overlap. The people who read and write Substacks, join and host Clubhouse rooms, and use Twitter are the same person. With Vine, Twitter was going after a new, younger demographic with a new type of content, more short-form comedy than exchange of ideas. Twitter, Substack, and Clubhouse host the same content in different formats.

New Twitter Product Development. Twitter is “building in public” with Spaces, soliciting input on decisions from which emojis it should use to how it should help Creators monetize. Plus, it’s been able to build quickly, because as @jwongmjane highlights, it’s re-using a lot of the tech from Periscope. New Twitter who dis.

Counter-Positioning Purity. Substack’s founders have said that they will never support ads. Clubhouse’s founders have said that they “never want video in Clubhouse.” Twitter can offer more monetization options and content formats to creators simply by not being purist about the product experience. Twitter should be the blank canvas for Creators.

Bundling. Thompson suggested that the ability to bundle Revue newsletters would be a goldmine. That’s definitely possible. To me, as a Creator, what’s far more compelling is the ability to bundle everything I create in one place. Instead of charging for a paid newsletter and access to private paid audio rooms in two separate places, and manually figuring out who wants both and adjusting accordingly, I could charge for one “Not Boring Bundle” right through Twitter, where most Not Boring readers are anyway.

I do think Clubhouse is better positioned against Twitter than Substack is, because so many people have been able to build up bigger audiences there than they have on Twitter so quickly, but it remains to be seen how easy it is for them to monetize and mobilize those audiences. If Clubhouse is available for less than $10 billion, I think Twitter should go all-in and take it off the market while other potential bidders like Facebook are tied up with antitrust concerns.

That’s another advantage Twitter has: despite, or because of, its history of slow product development and poorly-integrated acquisitions, Twitter is the only major tech company that I could see building or acquiring idea-based Creator tools and integrating them into a holistic ecosystem. Facebook also announced that it’s planning to launch a newsletter product, but I can’t imagine writing a newsletter on Facebook. My social graph doesn’t map nearly as well to readers as Twitter’s interest graph. And would you feel comfortable doing Clubhouse by Facebook any time soon? Because Twitter has monetized so ineffectively and developed product so slowly, it’s avoided some of the reputational damage its competitors face.

Twitter has fallen into a good spot, and it feels like it’s just getting started. Whether through partnerships, acquisitions, or in-house development, I expect that we’ll see more products like storefronts (via Square?), podcasts (maybe via Podz!), 1-1 video chats, communities, and more, all bundled together for one low monthly price.

Beyond traditional Creator tools, Twitter has an opportunity to serve each of the communities that thrive on the platform with integrated tools. Take FinTwit, in which I spend a lot of time. Would Twitter buy Public or Commonstock, two companies that create conversations around investing? Could it build new professional graphs and emerge as the LinkedIn killer, facilitating hiring in a market that’s shifting towards prioritizing peoples’ publicly demonstrated abilities over their resumes?

It will be fascinating to watch how Twitter connects all of its Creator products. Product VP Mike Park has already said that they are planning on letting writers host conversations with subscribers, one example of how Twitter might leverage its advantages to build a powerful Creator Ecosystem.

We might even see new ad formats that leverage Twitter’s interest graph to match sponsors with Creators whose audience Twitter knows is relevant, using the new business to bolster the core.

As Twitter builds out more ways for Creators and their followers to engage and exchange value, I expect it to finally turn profiles, “the most undervalued real estate on the internet,” into everyone’s own virtual home and store. I wouldn’t be surprised to see Twitter buy something like Beacons to help bring all of a Creator’s monetization channels into one place and make this a reality.

Importantly, as Twitter starts to show momentum, the narrative around Twitter as a company that can’t innovate will start to crack, and it will attract better and better talent, which will make it more innovative. Despite love for the product in the tech community, it’s hard to attract top talent to a company with a sluggish stock price that has been focused on infrastructure improvements and stopping Trump from inciting riots. It’s a lot easier to attract those people to build new products that all of their friends will use to connect and make more money.

And now, for the first time, Twitter is collecting a cut of subscription revenue from consumers via the 5% fee Revue charges paid newsletter writers, adding a small third business line to its existing Ad and Data businesses. At the earliest sign that this number is growing into something meaningful, the narrative around Twitter as a company that can’t monetize will crack, too, and Twitter will run.

Changing the Narrative

If Twitter were going public today, it would fetch a valuation much closer to $100 billion than its current $45 billion valuation. It’s growing users at 29% YoY, has a $3 billion per year ad business, a $500 million per year data business, and owns a free call option on building the Creator bundle.

As it stands, Twitter has a lot of legacy hair on it. It’s a hard company to manage, and it has not been managed as well as it could have been. But Twitter is emerging from the doldrums into a new era. It’s spent the last few years on unsexy work: revamping the foundations of its advertising technology, building better moderation tools, and surviving the most dramatic US Presidential election in history. Now, it’s having some fun, competing with the new entrants encroaching on its turf, and getting its groove back.

Changing the narrative makes all the difference. If it shows early signs of success in monetizing through newsletters and increasing engagement via Spaces, it will show that Twitter has a new life, investors will start to look for positive signs everywhere in the business.

That $3 billion ad business, which makes up the majority of Twitter, which trades at 9.8x NTM EV/ Revenue, starts to look more like Snap and Pinterest, which trade at 25.5x and 19.8x, than Facebook, which trades at 6.8x. That’s a potential $20-30 billion EV unlock.

The $500 million data business Twitter has built by selling its firehose of tweets starts to look like a pretty sexy SaaS business with proprietary access to the world’s best interest graph and real-time conversation data. Maybe it trades in line with the BVP Emerging Cloud Index’s average EV/Revenue multiple of 23.3x, giving it a value of $11.6 billion.

Backing out the data business from the current market cap leaves an ad business worth roughly $35 billion today. If the ad business traded at 15-20x, that’s $45-60 billion, and adding the data business back gets us to a $55 - $70 billion market cap. Just those two re-ratings combined would add $10 - $25 billion in market value, without any revenue growth.

And then there’s the Creator play. If 10% of the 10% of Twitter’s 187 million mDAUs who create 80% of the content, the Creators, build a paid product, and Twitter takes a 5% cut, that’s a $2.2 billion annual opportunity. If Twitter builds a subscription product with better DMs, bookmarking, note-taking, and search, and 25% of the Creators pay $20/month, that’s another $1 billion in annual revenue.

Together, that’s an additional $3.4 billion in revenue, doubling Twitter’s current number, without a single additional mDAU. Assuming those are valued in line with the BVP Cloud Index stocks, that’s another ~$70 billion in market cap. In this scenario, instead of holding top Twitter users hostage based on their follower count, Twitter makes money by helping Creators make more money.

Once Twitter starts showing even hints that it’s not the Twitter of old, that it can ingest acquisitions, build new products, and monetize, I think it’s ready to explode. Twitter makes a product that many people, including top investors can’t live without. When explaining why she bought Twitter in October, Anti-Galloway Portfolio creator Julie Young tweeted:

They (and I) are looking for any reason to buy more, and I think that Twitter is on the cusp of delivering. If you thought Redditors buying up Gamestop was a demonstration of the internet’s ability to move stocks, wait until you see what happens when the narrative about Twitter changes on Twitter.

And as for Jack? Whether accidentally or through an ultra-attuned third eye and a Zen-like ability to withstand half a decade’s worth of criticism, he’s put Twitter in a surprisingly strong strategic position. It’s the most credible front page and at-scale monetization engine for Creators right when the Creator Economy is taking off. Its ad product is making a comeback. Because it didn’t scare smart users away like Facebook has, it is where the world’s conversation happens. It has one of the most valuable data firehoses in the world. And if Twitter needs lightweight storefronts and a payments engine for this to really achieve liftoff, Jack knows a guy.

Not everything is fixed. DMs still suck. So does search. But Jack should get another year to prove that Twitter can execute under his leadership. Tomorrow’s earnings may go a long way in determining if he gets it.

Either way, I love Twitter too much not to be long, and I can feel the company getting its groove back. Maybe that’s my own narrative bias.

Thanks to Dan and Puja for editing!

Note: This is not investment advice, and I have no idea how earnings are going to turn out tomorrow. I’m personally adding into earnings (and will add TWTR to the Not Boring Portfolio as of today), because I believe that investors are looking for a reason to buy Twitter, but tomorrow’s earnings won’t reflect any of the upside we’ve discussed today. If it tanks on earnings, I will be backing up the Brinks truck.

Thanks for listening, and see you next week,

Packy

How Twitter Got Its Groove Back (Audio)